Complete Feature Overview

Everything you need for professional cryptocurrency tax calculations

Core Tax Calculation Engine

CRA and IRS compliant calculations for all tax scenarios

Canadian ACB Calculations

Fully compliant with Canada Revenue Agency requirements

- ACB method per CRA guidelines

- Superficial loss rule detection

- ACB pool management

- Multi-currency ACB support

- Schedule 3 & T1135 export

US Cost Basis Calculations

IRS-compliant methods for all scenarios

- FIFO, LIFO, Specific ID methods

- Wash sale detection & adjustment

- Lot management & tracking

- Form 8949 & Schedule D export

- Short vs long-term classification

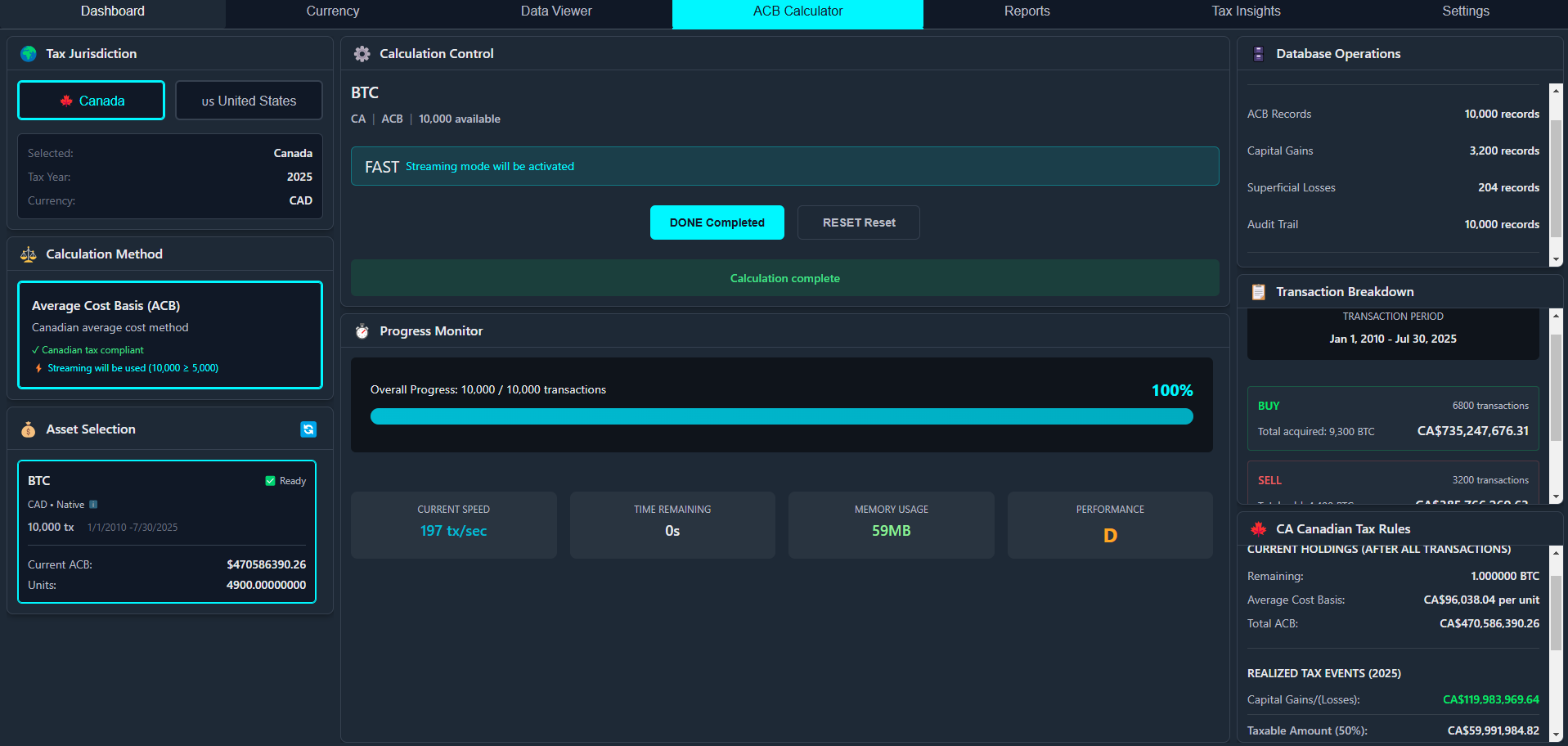

See It In Action

Professional calculation interface with detailed breakdown

Privacy & Security Architecture

Bank-grade security with zero cloud exposure

Local-Only Processing

Your data never leaves your computer

- 100% local calculations

- No account required

- Zero telemetry

- Offline capable

- You own your data

Military-Grade Encryption

Bank-level security for your financial data

- AES-256 encryption

- SQLCipher database

- Encrypted key management

- Memory protection

- Secure architecture

Data Integrity

Protection against data corruption

- Atomic transactions

- Backup integration

- Complete audit trail

- Validation layers

- Hash-based duplicate detection

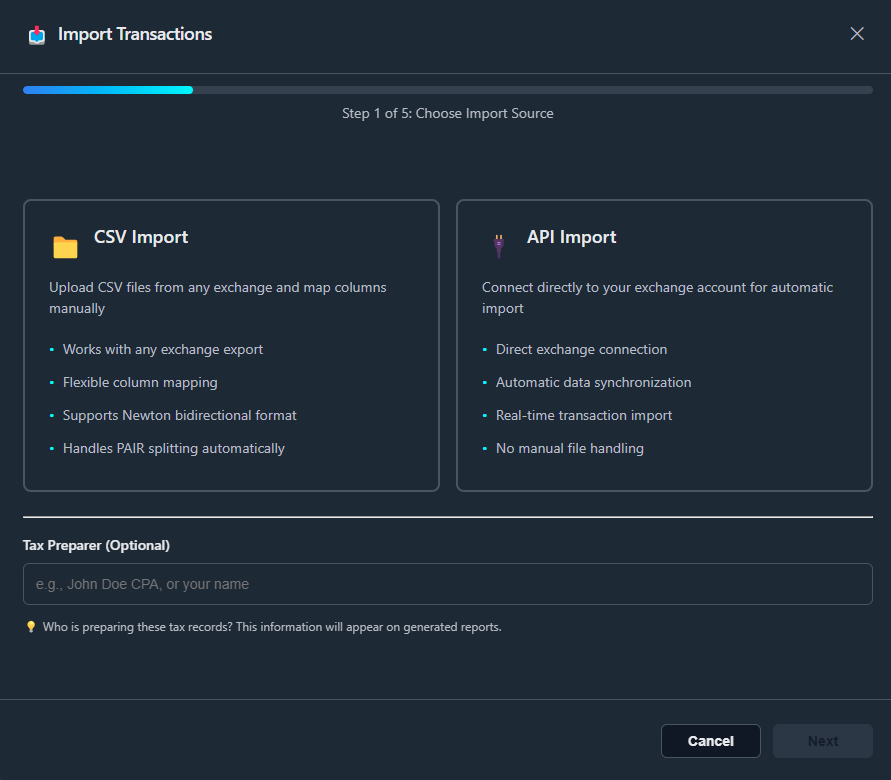

Data Import & Integration

Flexible import options for all your exchanges

CSV Import (All Editions)

Import from 8+ exchange formats

- Coinbase, Binance, Kraken, NDAX

- Newton, Shakepay, Gemini

- Generic CSV format

- Automatic format detection

- Duplicate detection

- Error recovery

API Import (Pro Only)

Direct integration for automated sync

- Coinbase direct sync

- NDAX integration

- Secure credential management

- Skip manual CSV downloads

- 🚀 Kraken coming soon

- 🚀 Binance coming soon

Enterprise-Grade Performance

Built to handle professional-scale portfolios

High Performance

Tested with large datasets

- 10,000+ transactions tested

- Streaming processing available

- Memory-efficient architecture

- Background calculations

- User-configurable performance

Smart Processing

Intelligent handling of complex scenarios

- Resume interrupted calculations

- Incremental updates

- Progress tracking

- Batch operations

- Real-time feedback

Professional Features

Advanced capabilities for Pro editions

Custom PDF BrandingQ1 2026

Add your business branding to reports

- Custom business logo

- Contact information

- Professional presentation

- Client-ready reports

- Perfect for tax professionals

Priority Support

Faster response times for Pro users

- Priority email support

- Faster response times

- 2 years of updates (vs 1 year)

- Early access to features

- Direct developer feedback

Standard vs Pro Edition

Choose the right edition for your needs

| Feature | Standard | Pro |

|---|---|---|

| Tax Calculations | ✓ All methods | ✓ All methods |

| CSV Import | ✓ 8+ exchanges | ✓ 8+ exchanges |

| API Import | — | ✓ Coinbase, NDAX |

| PDF Branding | — | 🚀 Coming Q1 2026 |

| Transactions | Unlimited | Unlimited |

| Support | Email (standard) | Email (priority) |

| Updates | 1 Year | 2 Years |

| Price (Canada/US) | $39 | $59 |

| Price (Both) | $69 | $89 |

Ready to Experience Professional-Grade Crypto Tax Software?

Download your free 30-day trial and see why traders choose PrivateACB